Prediction markets are leaking $78M annually

15 million free riders and counting

Thirty-seven years after the first modern prediction market was launched at the University of Iowa, prediction markets have finally found product-market fit.

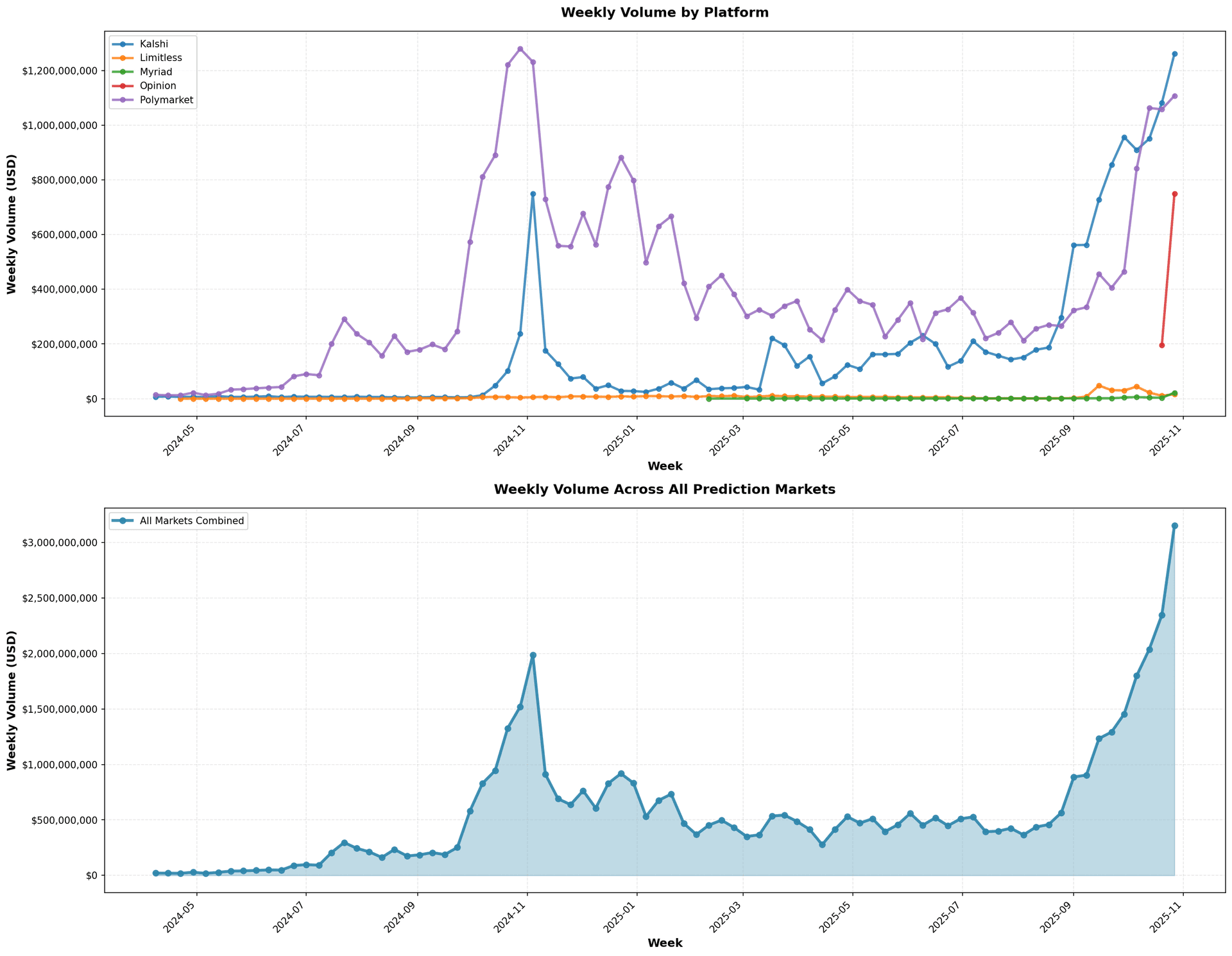

Weekly prediction market volume crossed $3B for the week starting October 27, 2025, and it is on a clear trajectory to play a large role in finance, news, and everyday life.

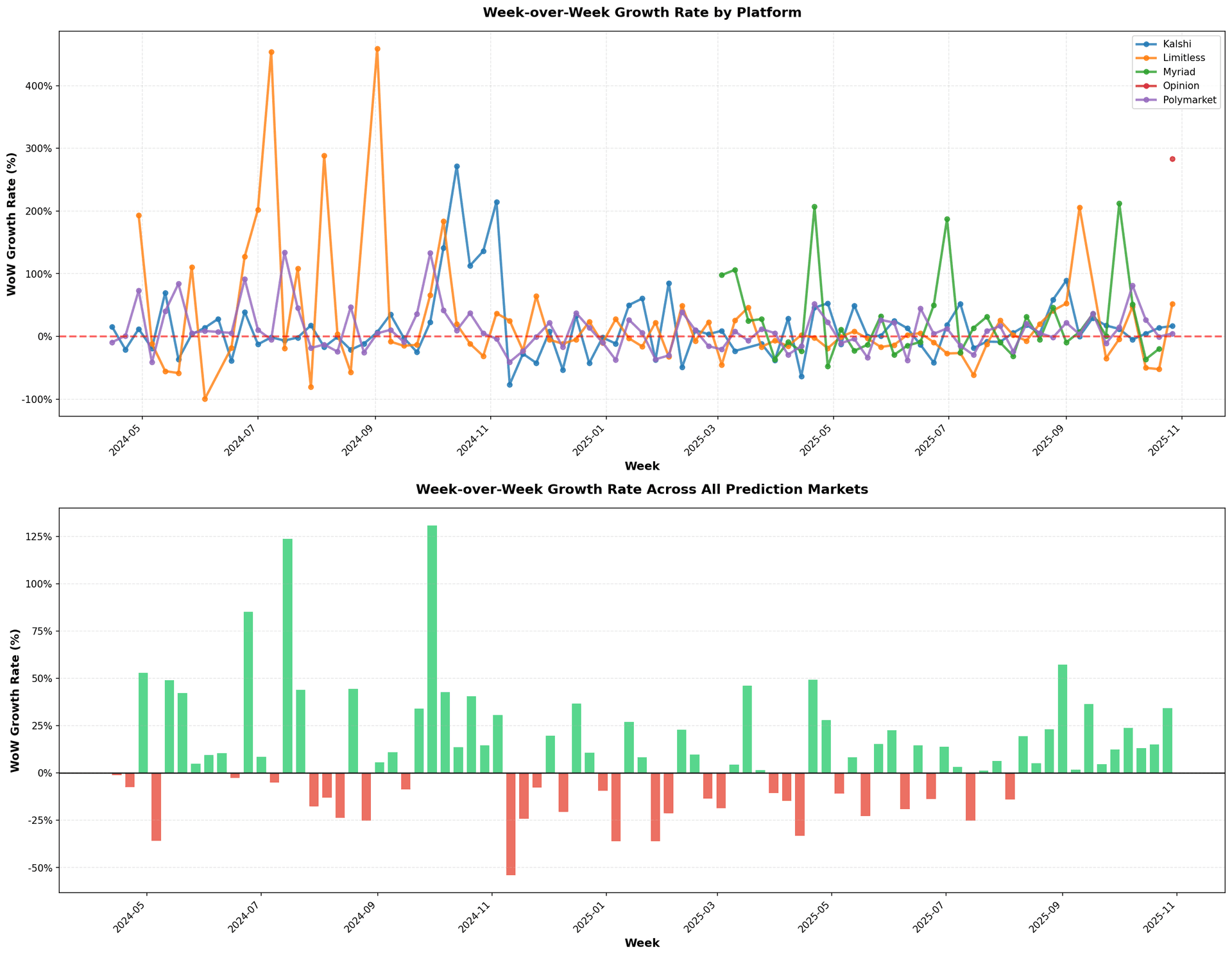

Prediction market volume is growing at 20-30% week-over-week:

For the week starting October 27, 2025, there were 9 million transactions across all prediction markets, and it is increasing by roughly 20% week-over-week:

It is too early to predict where the growth rate will begin to plateau. Extrapolating using a 5% week-over-week growth rate, weekly prediction market volume will be $10B in May 2026 and $36B in November 2026.

For reference, weekly volumes for global FX, US equities, and US equity options sits around $40 trillion, $2 trillion, and $750 billion, respectively. Spot volume across crypto onchain exchanges was $56 billion for the same week of October 27, 2025.

Some see the rise of prediction markets as evidence that society is at last catching up to the theories they've championed for decades. Others argue that this is a temporary equilibrium, heavily distorted by the gambler archetype willing to consistently take negative expected value bets, and that prediction markets are not an incentive-compatible market structure.

In this post, I outline the primary reason why prediction markets are not incentive-compatible in their current form, estimate the value leakage, and propose one temporary solution.

The output of prediction markets is information, which is a public good

The output of prediction markets is information of the probability of an event occurring. This is represented as a price from $0 to $1, which maps to 0% to 100% of an event happening.

Information is a public good. Once one person has information, anybody can acquire it instantly with zero marginal cost through the internet. Any user can visit a prediction market homepage and acquire information for free.

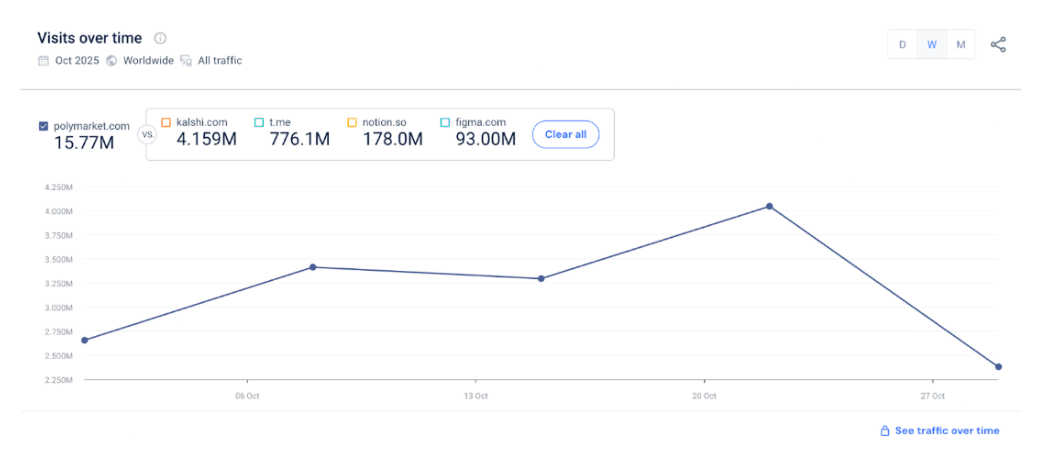

In October 2025, Polymarket had 15.77M visits to their homepage while Kalshi had 4.16M visits.

During this same time frame, Polymarket had approximately 225,000 weekly active users (traders), many of which are incentivized by Sybil, as anybody can make an arbitrary number of accounts connected to different crypto wallets. Kalshi data is not public as they operate fully offchain.

These 225,000 weekly active users do not translate to actual traders across markets.

The government shutdown market has been consistently featured on the homepage of Polymarket as this is the market that people want information on. In total, only around 1,000 unique addresses have traded on this market. Due to Sybil, this means that there are likely far fewer than 1,000 traders trading on this market. This makes intuitive sense: the only people willing to trade these markets are those with unfair information advantages (Congress members, friends of Congress, etc.).

The preeminent market with billboards plastered all over NYC had 26,000 addresses for YES Mamdani and 11,000 addresses for NO Mamdani. Yet only 1 out of 43,478 people who visit the site (0.0023%) actually traded in the market and contributed to price discovery. The long tail of prediction markets is far worse, often with only 10-20 unique traders.

The ratio of passive observers to active traders occurs because the same information is available to everyone. Information is a non-excludable good, both observers and traders have access to the same information, leading to an equilibrium where traders must be compensated by large financial incentives to pay for information.

Prediction markets are paying for this information via public and private liquidity incentives. currently being bankrolled by VC dollars. Prediction markets will eventually be forced to find avenues for economically sustainable monetization. This likely leads to advertising.

Estimating value leakage

ICE generates $2.5B annually from data services on $500 trillion in trading volume, yielding a 0.0005% monetization rate. Prediction markets offer a clean interface for a single market probability estimate for events rather than complex financial instruments with many input factors. The idiosyncraticity and ability to hedge idiosyncratic risk makes the information 100x more valuable. Applying a 100x multiplier to ICE's monetization rate yields a 0.05% monetization rate for prediction markets.

Applied to prediction markets' current $156B annualized volume, this suggests data revenue potential of $78M annually.

Note that this is obviously not a rigorous methodology. The purpose is to directionally quantify the value of the information being leaked by prediction markets.

The temporary solution

The simplest temporary solution is to tier access based on latency and granularity.

Traditional exchanges generate 20-50% of their revenue from selling data services, and are becoming an increasingly larger percentage of their revenue. In 2024, ICE and Nasdaq generated over $5B in revenue from data services (price feeds, analytics, etc.).

These data services include ultra low-latency price feeds, full order book depth, hidden order information, and other granular exchange data.

Kalshi can mimic this exact business model. Polymarket has to innovate at the margins since most of their data is available onchain, but can still offer data feeds and managed services to generate revenue.

There are many examples of successful managed services companies including Snowflake, Vercel, and Heroku.

Coda

Polymarket, Kalshi, or any other incumbent might rationally think: who cares? We can raise however much money in the short to medium term to cover any inefficiencies, and isn't growth at all costs the correct strategy?

There are two responses to this:

- Incumbency is not guaranteed and finding the correct market structure design is important for the long term viability of a prediction market platform.

- Large prediction market players may not be able to raise infinite money indefinitely.

Prediction markets should innovate toward an incentive-compatible market structure; there is very little evidence that they are moving towards this equilibrium. In the meantime, perfect should not be the enemy of good.

Many projects take this route, most notably Solana during the Jito mempool era.

Full incentive-compatibility should not be the only consideration for temporary solutions.