The Case For Alternative Ordering Mechanisms in Prediction Markets

Priority batch auctions as one better market structure to create more liquid prediction markets

The four major prediction market platforms, Polymarket, Kalshi, Opinion, and Limitless, all facilitate price discovery through an orderbook. Each market has an orderbook for each YES/NO outcome, which lists buy offers waiting for a compatible sell offer and vice versa.

The matching engine for the top four orderbooks occur offchain, as onchain orderbooks still remain unviable. All markets are matched first-come-first-served (FCFS), with the exception of live sports on Polymarket (more on this later). FCFS means that trades are processed exactly in the order that they are received. These orders are then processed by the orderbook matching engine based on price-time priority.

FCFS requires the public to trust that the companies running the infrastructure are operating honestly and not re-ordering transactions. In traditional markets, there is robust regulation to ensure that orders are processed on a FCFS basis. In prediction markets, these guarantees are much weaker given that the state of regulation for prediction markets is still in its infancy.

Nevertheless, orders are still very likely processed FCFS as existing prediction market platforms are not incentivized to risk their reputation by modifying their ordering mechanisms without notice. This is generally confirmed by rudimentary testing.

FCFS creates wider spreads and other negative externalities

FCFS creates a latency war to update prices as close to real time as possible. This creates a large incentive to co-locate with the matching engine of the orderbook to have the lowest latency and the ability to react to news events the fastest.

Recall that market makers make money by buying at a lower price and selling at a higher price. They make money when the fair price is between their bid and ask spread.

When the fair price moves before they can pull their stale quotes, they are picked off by takers.

When market makers have less certainty that they will be able to update their quotes in time to react to a new fair price (as is the case with FCFS), they are forced to widen their quotes. Wider quotes means worse prices for traders.

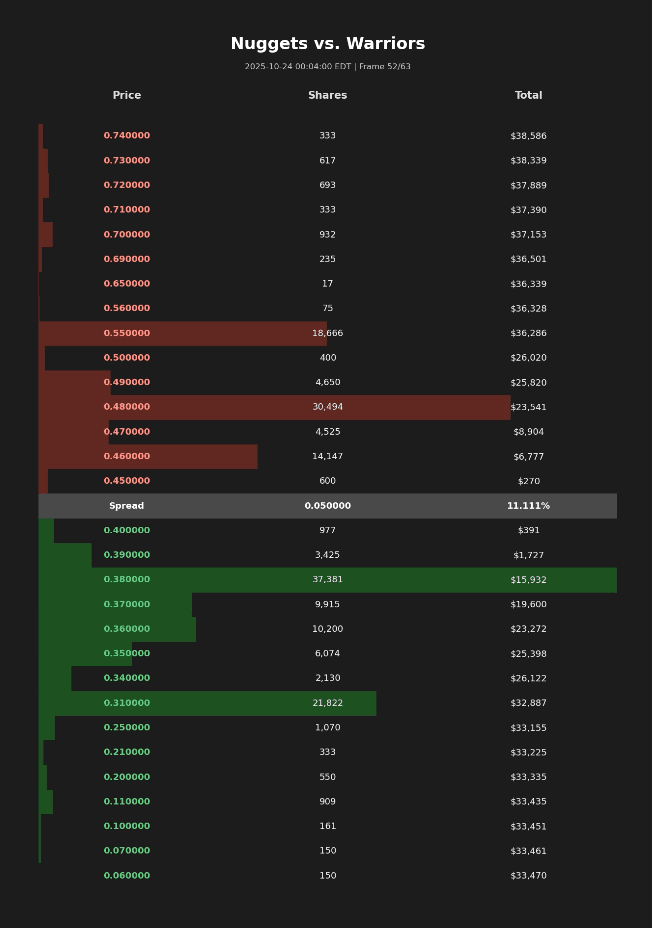

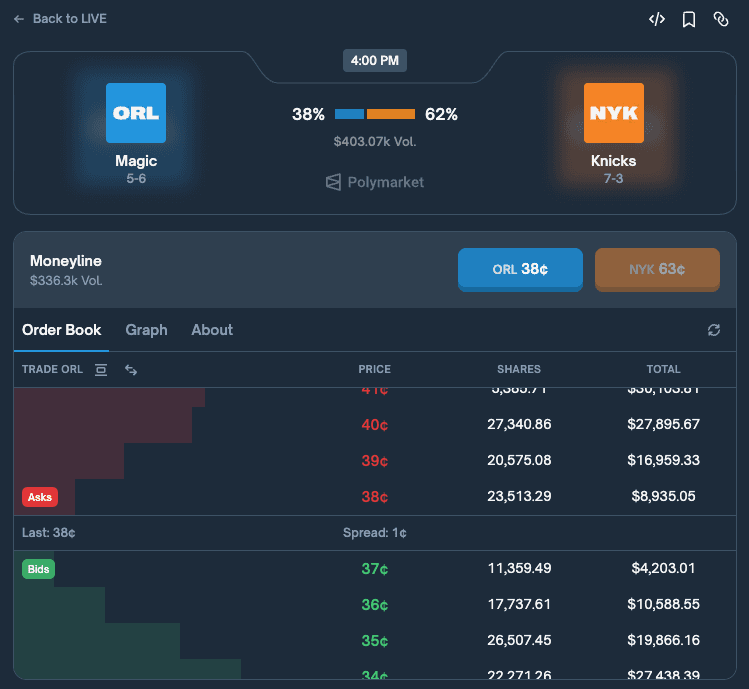

This dynamic is prevalent in every single live sports event. When the event is live, spreads widen as market makers don't have the time to react to information and to prevent being picked off by courtsiders:

While the spread appears to be $0.04, it is effectively much wider given the shallow liquidity. $3,000 of liquidity is negligible for any serious orderbook. Compare this to any random regular season pregame NBA market, which maintain $0.01 spreads with substantially deeper liquidity on both sides:

Takers dominate prediction markets

Because of the FCFS market structure, takers dominate prediction markets. A taker only has to be right once to pick off a market maker and be on the winning end of a trade, so taker strategies dominate. The most profitable traders all run taker strategies, where they scan various markets to pick off mispriced quotes from market makers. The large liquidity incentives to makers from Polymarket and Kalshi are proof of this dynamic.

Financial markets that order FCFS benefit takers. On Nasdaq, market makers are only able to update their quotes in time approximately 13% of the time. This means that 87% of the time they are picked off by takers. This is bad for makers but is a stable equilibrium given the Nasdaq's fee schedule and the underlying being a continuous asset and not a binary.

On prediction markets, FCFS is far worse given the whipsaw nature of binaries. A single second can provide new information to cause the price to jump from 1% to 100% (pope announcement, game winning shot, etc.). As a market maker, you co-locate as close to the matching engine as possible but you are still very likely to be picked off in a FCFS environment.

Priority batch auctions

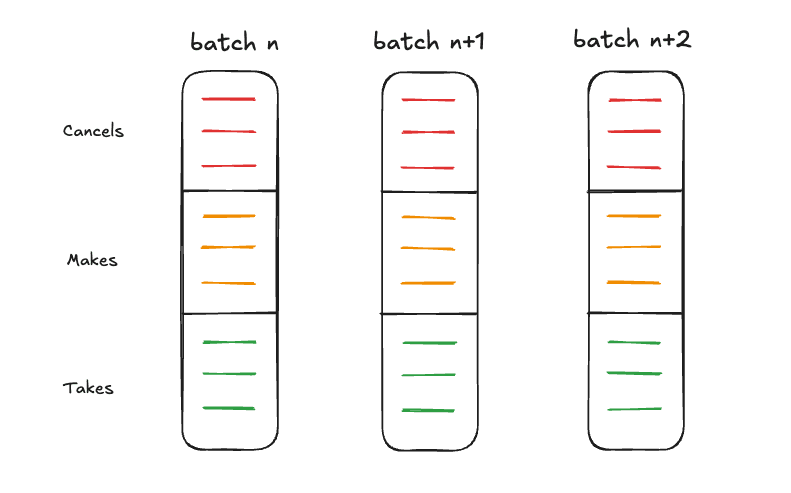

One solution is to batch orders across a given time period and order them based on a pre-defined ordering rule.

One such ordering rule for a prediction market could be implemented as follows:

- Process all cancel orders first

- Process all maker orders

- Execute taker orders

This levels the playing field by giving makers a chance to cancel stale quotes before they get picked off by takers. This reduces the advantage afforded to toxic takers in a FCFS environment.

Reducing toxic taker volume decreases aggregate volume but actually increases liquidity as makers are able to offer tighter spreads and deeper liquidity. This makes markets more efficient and users are able to get better prices.

If implemented onchain, cancel orders can be forced to pay a fee which can go back to the platform via revenue sharing or a buy and burn mechanism.

Batch frequency can be tailored to the nature of the underlying market. Consider the range of batch auction intervals in traditional finance:

- 100 ms: Aquis Exchange

- 15-30 min: stock market opening/closing auctions

- 1 hr: select electricity markets

Reasonable starting points for prediction markets might include:

- 10 sec for live sports such as basketball and baseball

- 1 min for news-based events such as the government shutdown ending and mention markets

- 1 hr for election markets with three years or more until resolution

Prediction markets could also experiment with dynamic batch auctions that occur at context-sensitive time intervals. For example, batch auctions at each dead ball in basketball or changeover in tennis.

Existing prediction market players are not incentivized to implement alternative ordering rules

It is very unlikely that Polymarket, Kalshi, Opinion, or Limitless will change their market structure by adopting alternative ordering rules such as priority batch auctions. There are several reasons for this:

- They benefit from maximizing raw transaction counts and headline volume, including wash trading, to juice their vanity metrics.

- Migrating to new ordering mechanics carries significant technical risk.

- Their existing trader bases are anchored to the current execution model.

Incentive farming (airdrops, rebates, point systems, etc.) amplifies these distortions by rewarding sheer activity rather than quality liquidity.

New prediction markets can differentiate themselves by launching with a more incentive-compatible market structure from day one.

The prediction market that creates the best market structure will host the most liquid markets with the best prices for users.